What is a Tax Appeal?

Tax Appeal may prevent or stop collection actions from happening. You can file a tax appeal in cases of a levy, lien, and audit.

To understand a tax appeal, it’s important to understand the IRS collection process. When you have a tax liability, the IRS has the right to pursue various collection actions to collect the money owed. The most common collection actions are liens and levies, but they can be as severe as property seizure.

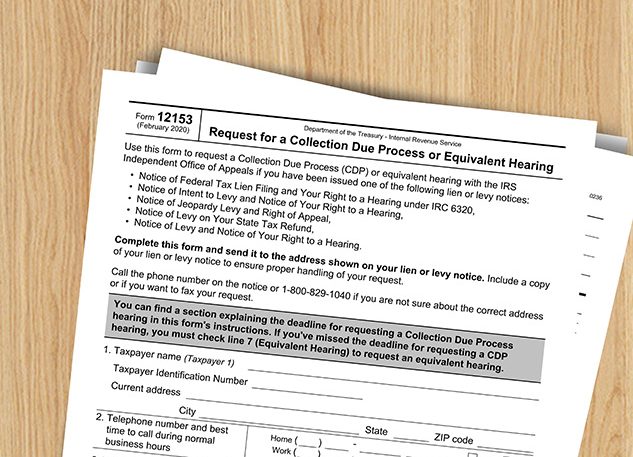

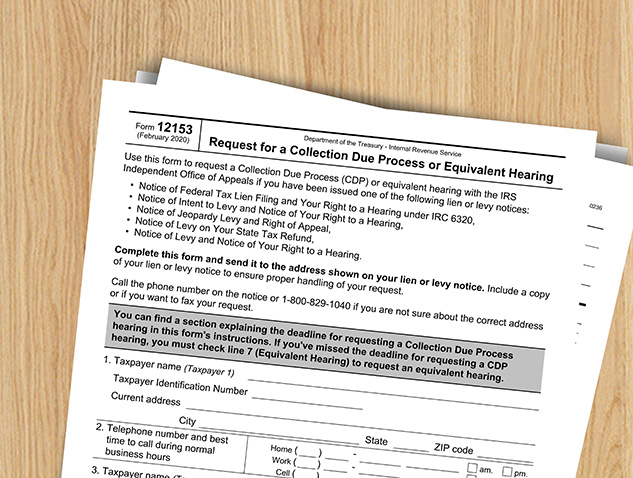

To provide taxpayers with recourse in the event of biased or unreasonable actions by the IRS collections department, IRS allows appeal rights on certain notices and actions. This allows a taxpayer to submit a tax appeal and engage an independent IRS office — called the Office of Appeals — to review the facts of the case and make a determination without influence from the collections department. The Office of Appeals has the authority to place a taxpayer in a resolution if they find that the facts support it.

The two main types of appeals are Collection Due Process (CDP) and Collection Appeals Program (CAP). The type of appeal available is dependent on the notice or action pursued by the IRS, but both types provide the opportunity for a taxpayer to explain why they disagree with the collection actions being pursued. An appeal can be submitted for multiple tax types and tax periods, but there is a limited amount of time to do so.