OVERVIEW

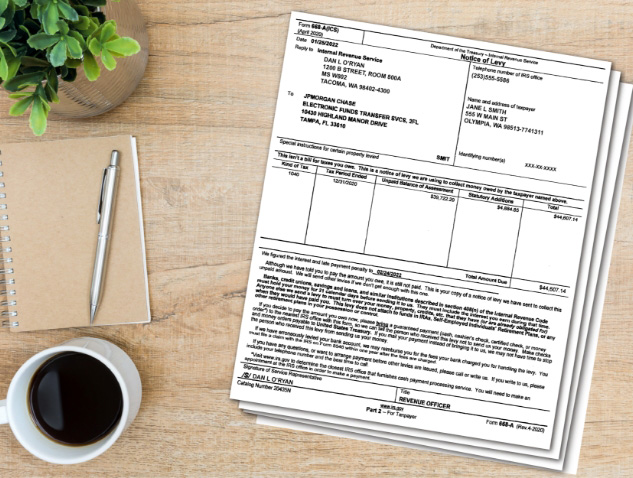

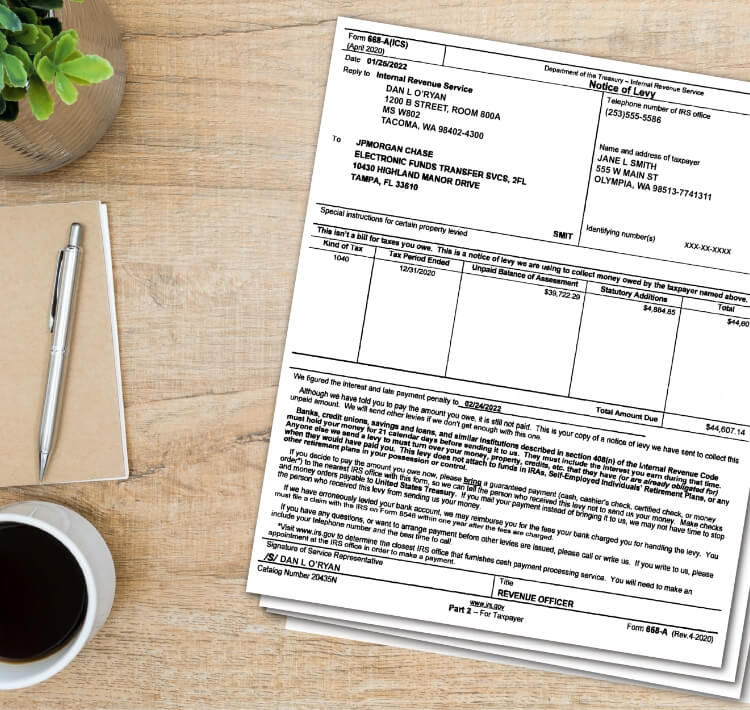

What Is A Tax Levy?

A tax levy is a legal seizure of assets in an effort to force the settlement of a delinquent tax bill. Tax levies often happen after tax liens are placed on assets like vehicles or other property, but not always.

Typically, tax levies aren’t the first method the IRS or state tax authority uses to collect on a tax debt. And, once a tax levy is in process, it’s very difficult to stop it without either paying your tax bill in full or negotiating a different arrangement.