What Is a Federal Tax Lien?

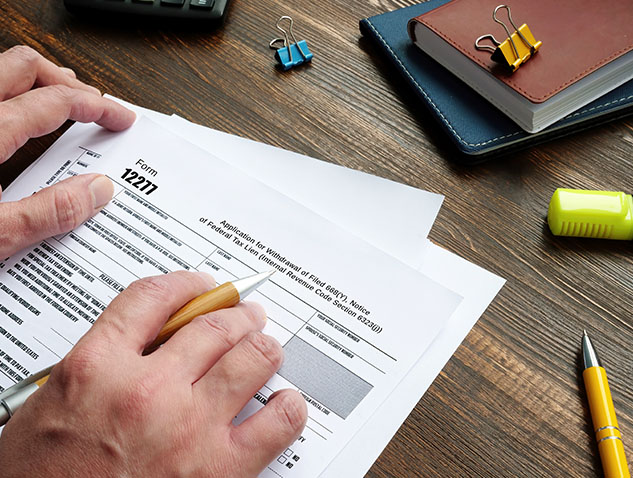

A federal tax lien is a statutory claim against all property owned by a person owing taxes. The filing of a federal tax lien provides security to the IRS for payment of the tax debt owing.

Federal tax liens are filed when a taxpayer doesn’t pay their back taxes. These liens include tax, penalties, and interest owed.