Explanation on Estimated Payment requirement and how to make it

The Internal Revenue Service requires for certain individual taxpayers to make Estimated Tax Payments. Estimated tax is the method used to pay on income that is not subject to withholding (i.e. self-employment, rent, dividends, etc).

The general rules for this requirement are:

- You must make the payments if you expect to owe at least $1,000 in individual income tax for the current year (after subtracting your withholding and credits).

- You must make the payments if do not you expect your withholdings and refundable credits to equal at least the lesser of the following:

- 90% of the tax that will be shown on your current year tax return, or

- 100% of the tax shown on last year’s tax return (the prior-year return must be for the entire 12 months).

If you think you will have a tax liability on your Form 1040 U.S. Individual Income Tax return for last year and your income remains the same this year, you are likely required to make the Estimated Tax Payments.

When to make the payments

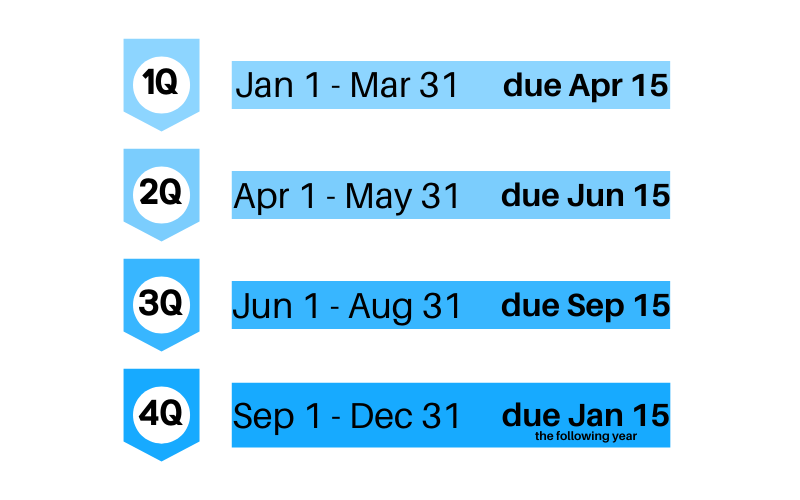

The due dates for the quarterly payments are as follows:

How to make the payments

You can make Estimated Tax Payment using the following methods:

Mailing

To mail the payment, you must use the Form 1040-ES payment voucher. This form has full instructions on where to mail your payment. Keep in mind that it takes the IRS up to 14 days to post a payment (could be longer due to COVID-19) and your payment is marked as received on the date they receive the mail, not the postmark date.

Online Payment

To ensure your payment is received by the due date, the quickest way is to make an online payment. You can make online payment using multiple methods below:

- IRS DirectPay – this option allows you to make different types of payments without having to sign up for an account. It is free to use and you can only use a bank account as source of payment.

- IRS EFTPS – this option allows to make different types of payments. You do have to sign up and the process to be fully enrolled can take a few weeks. It is free to use and you can only use a bank account as source of payment.

- Credit Card – this option allows you to make different types of payment using a credit/debit card and there are fees associated each time you make a payment.

If you think you may owe more taxes than what you can pay right now, feel free to call us at 800-540-0433 to start discussing your tax resolution options.